Shared Ownership Staircasing: The Process Explained

August 17, 2023 | Laura Whittle

If you are considering buying a home through shared ownership or you are already a current shared owner, you might be interested in finding out more about shared ownership staircasing if you want to buy more of your home – either now or in the future.

We have put together this quick guide to help you better understand the process.

What is shared ownership staircasing?

To put it simply, shared ownership staircasing is the process of buying more shares in your home. You can choose to staircase if and when you wish, but you are not obligated to.

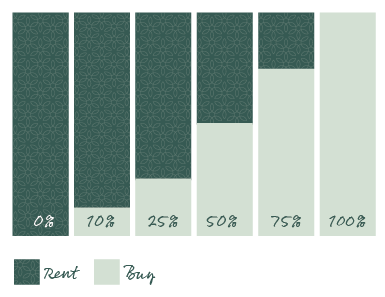

Owning more shares means you have more equity in the property and pay less rent, and if you are able to staircase to 100%, you will own the home outright and pay no rent at all, depending on your lease.

Key benefits of shared ownership staircasing

- Pay less rent – As you buy more shares, your mortgage will increase and the amount you pay in rent will go down.

- Own the freehold – In most cases, you will be able to buy the freehold once you staircase to 100% (excluding apartments).

- Benefit from house price increases – The greater the share you own, the more you will benefit from any increases in property prices.

- Easier to sell – Once you own 100%, you will no longer be subject to a nomination period, or any other restrictions if you decide to sell the property.

The staircasing process – original shared ownership model

Under the current shared ownership model, the minimum share you’ll be able to buy when you staircase is 10%.

The first step is to contact your housing provider and let them know that you intend to staircase.

Next, you’ll need to pay for a valuation from a surveyor who is registered with the Royal Institute of Chartered Surveyors (RICS). This valuation will be valid for three months.

It’s worth noting that shares are sold at their current value, not the value of your home when you bought it.

The staircasing process – new shared ownership model

As part of the government’s Affordable Homes Programme, a new shared ownership model was recently introduced, resulting in some changes to the staircasing process.

Under the new shared ownership model, buyers have the option to staircase from as little as 1% each year for a period of 15 years from the date of purchase.

However, it’s worth noting that you will be required to pay legal fees each time you do this.

Shared owners who wish to take up the option of the 1% staircasing will not be required to pay for an independent valuation.

It is advised that you appoint a solicitor that has experience in staircasing to act on your behalf, and you will need to provide their details to your housing association.

Once you complete on your staircasing transaction your rental amount will be adjusted accordingly.

If you’re unsure which shared ownership model applies to you, check your lease and the Key Information Document about your property, or speak to your housing provider.

How often can I staircase?

You can either buy more shares in increments, or you can buy the remaining share of your property in one transaction.

Staircasing in the larger amounts avoids paying administration and solicitor fees more than once.

The minimum share you can purchase will be stated in your lease. However, if it is the final share purchase, it may be less than the minimum share in order for you to staircase up to 100%.

What are the costs of shared ownership staircasing?

As well as the price of the actual shares you are buying, there are also some additional costs you may need to consider each time you staircase, including:

- Valuation fees – you’ll need to pay for a RICS-registered valuation report

- Legal fees: You will need a solicitor or conveyancer to handle the legal work involved in shared ownership staircasing.

- Stamp duty. Depending on the value of the additional shares you are buying, you may have to pay stamp duty.

- Mortgage fees. If you’re paying for your additional shares through extending your existing mortgage or re-mortgaging, you may have to pay mortgage fees.

Download our staircasing guide

If you are an Onward Living homeowner and you are interested in shared ownership staircasing, please contact our Home Ownership team on 0300 555 0600 for more information.

You can also visit canistaircase.com to find out if staircasing is for you.

Find Out More